Digitizing Trade Operations

Learn more about how J.P. Morgan utilizes Cleareye’s ClearTrade platform to help future proof the challenges faced by Trade Finance Operations today.

As our industry continues to change moving beyond the COVID pandemic, we have even more reason to focus on the digitization of trade. Cleareye’s ClearTrade platform offers customization to streamline the manual and paper-heavy processes associated with due diligence. The strategic alliance between both J.P. Morgan and Cleareye will allow Cleareye to bring automated straight through processing to banks across the globe.

James Fraser

Global Head of Trade & Working Capital, J.P. Morgan

A strategic alliance between J.P. Morgan and burgeoning fintech, Cleareye.ai, has resulted in a unique opportunity to future proof the global trade business.

Imagine reducing your average processing time from three hours to 10 minutes. This efficiency gain is not limited to imagination, but the reality of a global strategic alliance that aims to bring a pioneering solution to ease the critical pain points of thousands of banks globally.

The J.P. Morgan Cleareye alliance leverages an industry-leading digital solution, ClearTrade, to solve both the challenges Trade Finance operations face today and tomorrow. Through significant advances in technology, the ClearTrade platform streamlines the onerous due diligence processing associated with Trade Finance transactions and the multitude of physical documents that are still prevalent in the industry today.

As operational challenges and regulatory pressures continue, Cleareye's AI technology is instrumental in ensuring financial institutions' ability to streamline their documentation review process and help to future-proof our clients’ business. We are proud to strategically align with Cleareye as they share our innovation agenda and our rigorous compliance and technology standards .

Tom Fitzgerald

Global Head of Trade & Working Capital Product Delivery, J.P. Morgan

Reducing the operation processing time not only helps to save costs and promote efficiencies, but also increases trade velocities.

The outcome of this increased digitalization includes:

- Smart interpretation of data and documents to automate letter of credit document examination

- Contextual and configurable rules engine to supplement existing Uniform Customs and Practice for Documentary and International Standard Banking Practice rules

- Identification of Trade Based Money Laundering (TBML) and sanctions red flags

- Seamless integration into any existing Trade Finance back-office platforms

The Challenges in Trade Finance

Operational Challenges

A manually intensive industry which is burdened by paper & lacks standardization

Exposure to potential losses as a result of human error, such as incorrect data entry, examination and decision making

A Shrinking Workforce

The industry faces a shrinking workforce, with large turnover globally

Those who remain have a specialized skillset and invaluable experience making them extremely difficult to replace

Compliance Scrutiny

Every Trade Finance bank is facing an ever-changing and increasingly complex regulatory landscape

The increasing scrutiny and need for auditability associated with a transaction is near impossible to achieve with human decisioning

Increasing Cost Base

An increasing cost base that makes remaining competitive extremely challenging

High cost of maintaining manual compliance screening teams with limited integration to external platforms

Through this strategic alliance, J.P.Morgan is able to extract, validate and accurately classify unstructured data, with comprehensive compliance and trade based money laundering (TBML)

Cleareye Offers..

Digitization

Digitization of Documents

Automated classification, extraction and validation of information mapped to back-office systems

Sanctions Screening

Comprehensive Noun Extraction and elimination of duplicates for efficient sanctions screening with integration to enterprise screening utility

Compliance

Red Flag Management

Automated and user assisted identification of TBML red flags, fair price, dual use & high risk goods

Vessel & Bill of Lading Check

Validation of Vessel & Bills of Lading, including flagging sanctioned entities (i.e. vessel owners & operators) and port calls to high risk countries

Auto Doc Examination

Dynamic Rules Engine

Contextual and configurable rules engine per industry standard UCP & ISBP rules

Auto Doc Examination

End to End workflow solution, identifies discrepancies & enforces doc exam rules with full back-office integration

Digitization Module

Digitization Module uses ICR/OCR & NLP (Natural Language Processing) to extract information found in documents and map data directly to your back-office system allowing for operational efficiencies and improved sanctions screening

Imaging of Documents

Classification & Extraction accuracy at 98% and 93%, respectively, out pacing legacy applications (around 65%)* with a growing set of trained documents

*Oct. 18-31

Sanction Screening

Efficient sanctions screening via noun extraction and deduping with context (data field mapping) integrated to existing enterprise screening utility

- Significantly reduce efforts for Screening Team when reviewing flagged items, without sacrificing on regulatory compliance

- Reduces the cost per transaction, with faster processing times

Compliance Module

The Compliance Module uses the data extracted from the digitization module & applies a series of red flag and vessel & container checks that provides information to help better control and navigate risk associated with each transaction

Red Flag Management

Digital work bench equipped with automated TBML checks capable of identifying risky parts of transactions such as goods, entities, and generating automated alerts

- Aids user in the assessment of red flags & maintains audit trail, evidencing of actions carried out by analysts

- Compliance thus effectively manages assessment of transaction and complexities of implementing controls while staying current with regulations

The Compliance module has provided the capability for comprehensive screening across all transactions for Trade Based Money Laundering, which otherwise was done only on escalated transactions.

- We experienced a 70% decrease in required headcount to uplift global markets to higher standards

Vessel & Bill of Lading Check

Data extracted from shipping documents enables review of vessel name, vessel flag, Owner and/or Beneficial Owner, IMO number and port calls for a stipulated period

- Flags sanctioned vessels & identifies sanctioned countries associated with ship’s operator & registered owner

- Validates movement of goods confirming vessel’s port of loading

Checks are highly configurable giving banks the flexibility in how to apply checks to high-risk goods, jurisdictions & voyage related red flags. Allowing banks to meet the needs of their internal compliance teams

Automated Document Examination Module

The module uses advance technologies to interpret and identify rules and conditions while validating against the presentation documents to optimize trade operations

Auto Doc Examination

Automated classification, extraction and validation of information in trade documents using advanced techniques

- System interprets entire LC validating the presentation documents against rules in an automated manner

- Additional features includes LC life cycle management, amendment & beneficiary consent handling

- Generates a document-based discrepancy report that integrates seamlessly and securely with your existing trade processing system

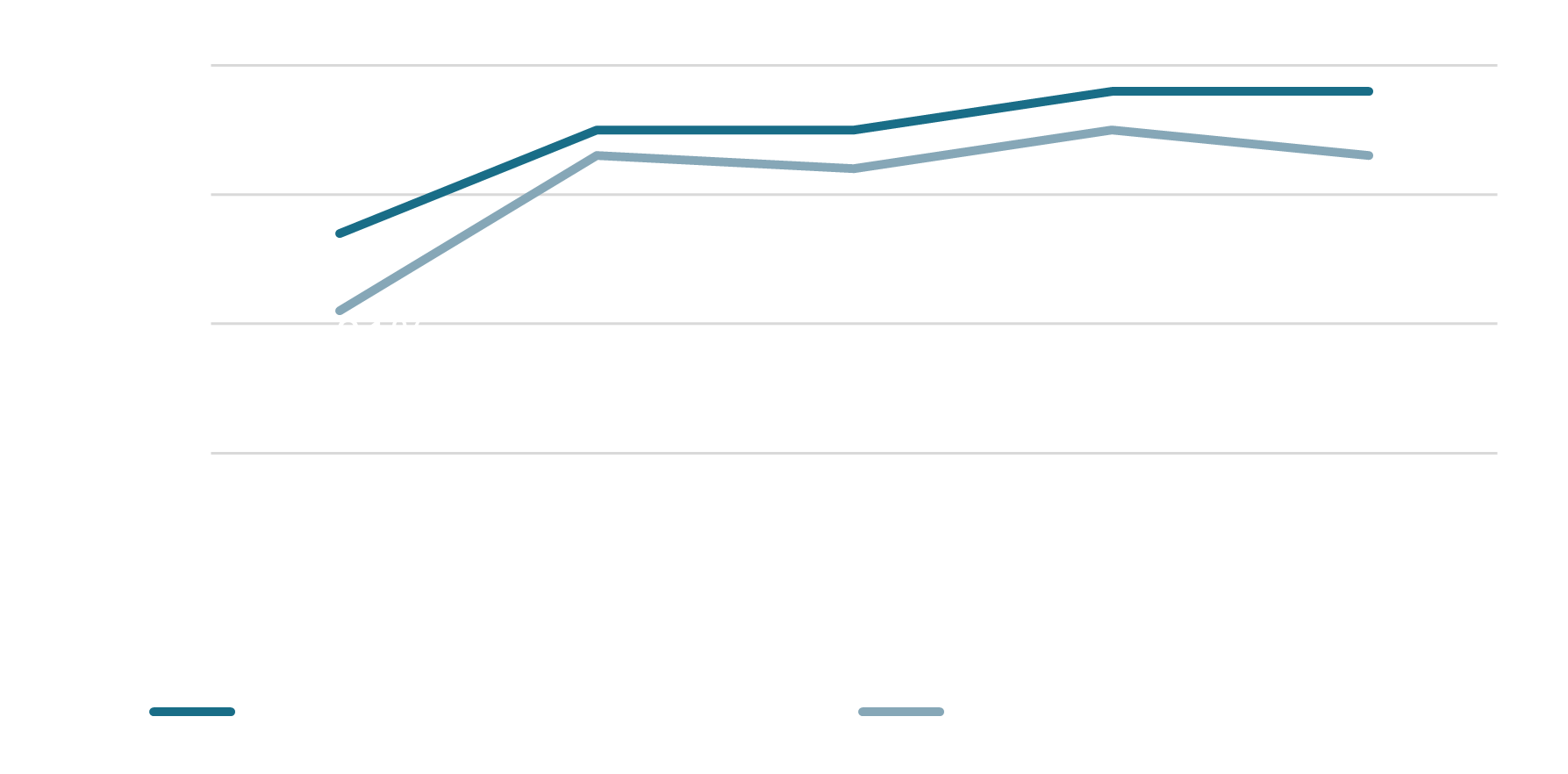

Doc Processing time is currently sitting at 85 min, down from 125 min, with planned improvements forecast to achieve 55 min

Dynamic Rules Engine

Configurable rules engine with no dependency on IT & production support to implement rule changes

- Customizable and flexible rules with ability to create and apply based on geography & client

- Complete coverage of UCP, ISBP & URC Rules

- Ability to classify discrepancies based on specified rules

- CT delivered 135 J.P. Morgan specific rules within 90 days

Connect with our team

Tom Fitzgerald

Managing Director & Global Head of Trade & Working Capital Product Delivery and Innovation

Brendan Werner

Vice President, Trade & Working Capital Product Delivery and Innovation

Disclosure

Subject to Client consent, J.P. Morgan Chase Bank, N.A. and any of its affiliates or branches (the Bank) may disclose to Cleareye.ai information necessary to facilitate an introduction, which information may include business contact (i.e., name and email address). The Client is responsible to ensure that all legal rights necessary, including those under applicable data protection laws, to provide the Bank with such information have been established. The Bank holds a warrant from Cleareye.ai and may receive an equity interest in the future. The Bank may profit from the Client’s use of any products and/or services provided by Cleareye.ai and the Bank is not endorsing Cleareye products and/or services nor does it advise on the suitability of these services for the Client’s needs. The Client shall make an independent determination as to the selection of products and/or services provided by Cleareye.ai. The Bank shall not be liable to the Client for any loss or liability suffered by the Client from its use of Cleareye.ai products and/or services.