J.P. Morgan + SAP:

A deeper strategic partnership for integrated banking capabilities

Meet clients where they are with the global reach, experience and strength you’d expect from two industry leaders.

98

of the largest 100 companies in the world are SAP customers1

84%

of global commerce orchestrated through SAP1

$10T+

payments processed daily by J.P. Morgan2

Art of the possible

See how SAP S/4HANA–powered by the AI Copilot Joule–combined with innovative financial services from J.P. Morgan–delivers the financial control and operational effectiveness needed to navigate change and drive transformation.

For demonstration purposes only. The use cases and data used herein are not real. Functionality is not commercially available today.

Empower business success

- Accelerate global expansion: Helps facilitate more seamless integration and support for global business growth

- Enhance financial performance: Aims to improve financial outcomes by optimizing processes and providing strategic insights

- Drive cloud modernization: Supports the use of automation and AI to modernize cloud infrastructure and operations

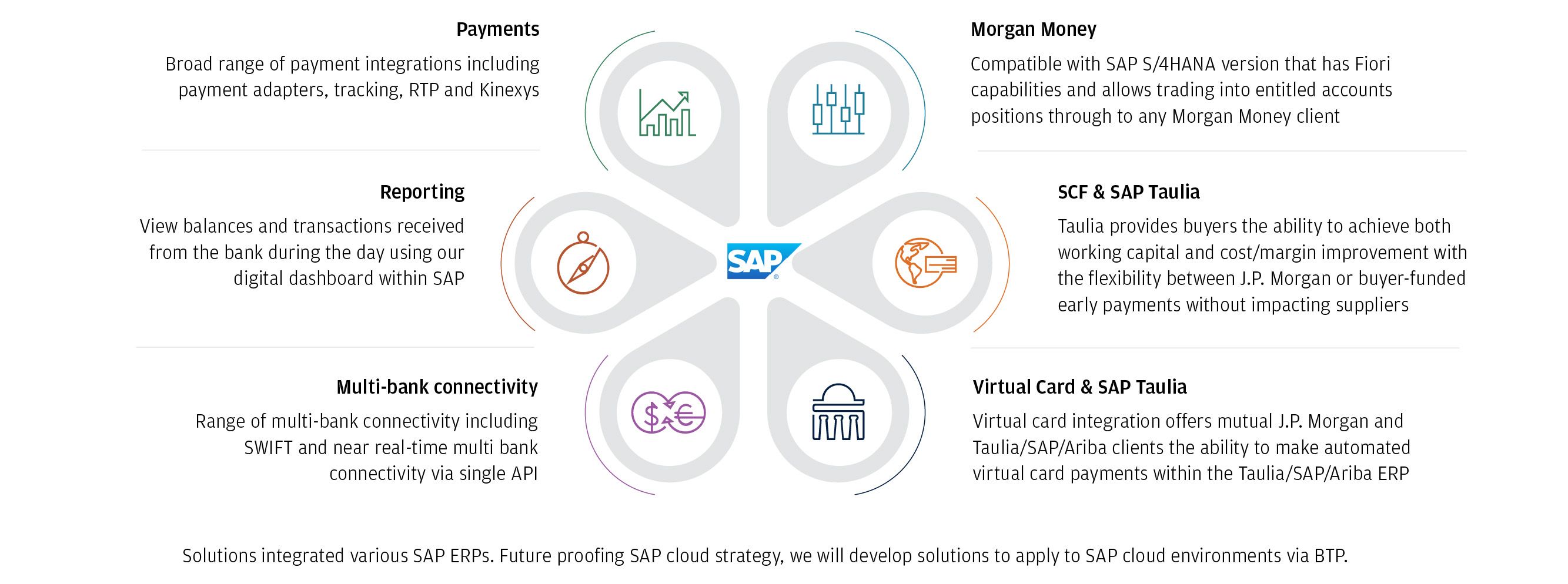

Drive your treasury goals with an integrated banking experience from J.P. Morgan + SAP

Help meet your business requirements today and scale your business for the future with the J.P. Morgan multi-product solution for SAP, offering simplified banking integration and a comprehensive set of banking capabilities.

More ways J.P. Morgan + SAP

are working together

SAP Integrated Solutions Video

Experience the power of our integrated solutions with SAP. Watch the demo to see how our collaboration can help transform your business operations.

Payments Partner Network

Learn more about the new SAP Partnership and explore our extensive payment solution offerings across the J.P. Morgan Payments Partner Network.

Frequently asked questions

Get answers to some common questions about our work with SAP.

About the J.P. Morgan + SAP partnership

What is the nature of the partnership between J.P. Morgan Payments and SAP?

The partnership between J.P. Morgan Payments and SAP involves a direct collaboration aimed at accelerating payment integrations. This strategic alliance enables both companies, two of the leaders in their industries, to expedite the development of next-generation integration solutions. It is important to note that the art-of-the-possible demo is not a product but rather a showcase of potential future innovations.

Doesn't J.P. Morgan already work with SAP?

While J.P. Morgan has previously worked with SAP through third-party integrations–such as those involving trade and virtual card services via SAP's company, Taulia–this new initiative marks the formalization of a direct partnership with SAP. This partnership launch, distinct from a product launch, is expected to empower J.P. Morgan to accelerate client-centric integrations and better meet the needs of our clients. For information on existing integrations, please refer to the details provided below.

What is the role of the System Integrators (SIs) in the partnership?

With the partnership between J.P. Morgan and SAP, System Integrators (SIs) will enhance and support the collaboration. Specifically, EY, Accenture and Tech Mahindra have been selected by both SAP and J.P. Morgan to amplify the partnership's impact and effectiveness.

Are there any specific products or services being developed because of this partnership?

In the initial phase of our partnership, we are focusing on specific use cases, including Joule, Kinexys, supply chain finance and virtual card services via Taulia. We are committed to developing additional use cases based on client feedback and will continue to update the site as new opportunities are identified and prioritized.

Is the demo a product?

The demo symbolizes what J.P. Morgan and SAP believe could be possible when two technology-forward companies come together to drive innovation for clients.

Where can I learn more about the existing solutions?

Visit our Payments Partner Network using the link above to learn more about our existing solutions with SAP.

Integrated Solutions for SAP

Is the J.P. Morgan Integrated Solution for SAP an application or direct integration?

J.P. Morgan partnered with Findroids to develop a global ERP application tool for SAP clients. This is not a direct integration, and clients will need the proper resources to implement the application tool into their SAP ERP.

Do you have to be a J.P. Morgan client?

Yes, you need to be a J.P. Morgan client using SAP S4/HANA or ECC 6.0 and above.

What offerings are available, and does the client have to implement all features?

Our Integrated Solution has SAP Payment Adapter 2.0 as well as real-time treasury features including cash visibility, payment tracking for cross-border wires, reporting and real-time payment initiation. Clients can choose which features they would like to implement.

What SAP versions support this integration?

This solution is only available for SAP S4/HANA and ECC 6.0 or above.

Does the client have to manage the security credentials?

Clients are required to manage their own security credentials following our BAU process. Our technical Implementation team will assist client with questions upon TIM assignment.

What is the support model for this Integrated solution?

Clients would advise J.P. Morgan CSAM if they are having issues with the integrated solution. Findroids will engage in servicing after installation of the payment adapter or the SAP RTT app if a product issue determined.

Ready to see how our ecosystem can support your business?